Sunday, March 30, 2014

Saturday, March 29, 2014

Weekend Links

Big data: are we making a big mistake? - FT.com: http://t.co/DT9vDgX via @AddThis

State of Journalism: The Lost Art of Fact Checking | LinkedIn: http://t.co/yRiZtQZ via @AddThis

How Busy People Make Time To Read--And You Can Too | Fast Company | Business + Innovation: http://t.co/kILRQAU via @AddThis

Kindergarten teacher: My job is now about tests and data — not children. I quit.: http://t.co/8SslZPs

Blue Bottle coffee: VCs’ search for the new Starbucks starts in San Francisco.: http://t.co/DAsipkh

There’s No Substitute for Good Judgment | Above the Market: http://t.co/EOLSVTI via @AddThis

The March Madness Vasectomy «: http://t.co/UPydEme via @AddThis

What I learned from negotiating with Steve Jobs: http://t.co/6CvM20i via @AddThis

Videos:

Why did CEO pay got out of hand ? Buffet on youtube

Parasite Rex: Inside the Bizarre World of Nature's Most Dangerous Creatures

Jim Grant lecture: Hazlitt, My Hero Youtube

Friday, March 28, 2014

Friday, March 21, 2014

Weekend Longform Links

- "Nate Silver and the Emptiness of Data Journalism" http://rdd.me/em9rzh6g via @readability

- "The Scottish pound myth" http://rdd.me/fklunf0r via @readability

- "The slow death of the microwave" http://rdd.me/szpmr0vt via @readability

- "No, Nate, brogrammers may not be macho, but that’s not all there is to it" http://rdd.me/ga7orrob via @readability

- "The Secret World of Fast Fashion" http://rdd.me/n60qkqkj via @readability

- "Hoard d’Oeuvres" http://rdd.me/ljgule2p via @readability

- "Excerpts from Mosaic: Perspectives on Investing (Mohnish Pabrai)" http://rdd.me/hl6lvem6 via @readability

- "The Paradox of Self-Determination" http://rdd.me/fchwurln via @readability

- "Can TOMS break into the coffee business? - Fortune Features" http://rdd.me/wkx2bwmw via @readability

- "An Interview with WiseBanyan CEO Herbert Moore" http://rdd.me/kzhswidt via @readability

Thursday, March 20, 2014

FW: Tanker Tracker

Feed: The Big Picture

Posted on: Thursday, March 20, 2014 11:30

Author: Barry Ritholtz

Subject: Tanker Tracker

Tuesday, March 18, 2014

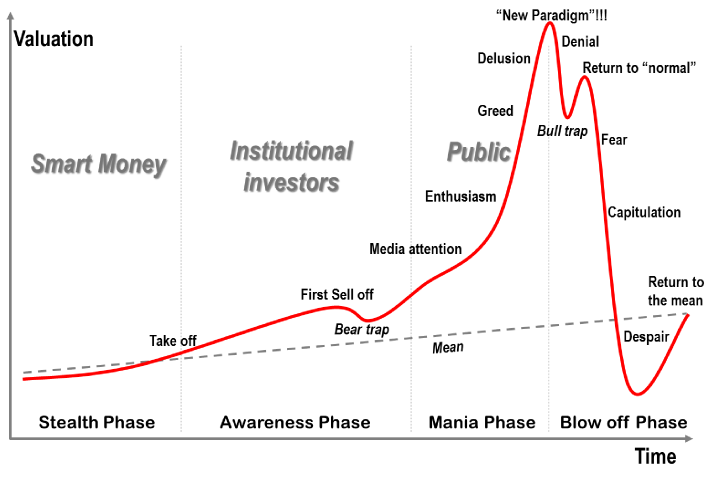

FW: Where Are We in the Bubble and Mania Cycle?

| Bubbles and Manias Josh Brown reminded us yesterday of this terrific chart from Jean-Paul Rodrigue, a professor in the department of global studies and geography Department at Hofstra University. Of course, the key question is: Where are we on the chart? My view is that we're through the "Awareness" phase as many of the bears have already thrown in the towel (Jeremy Grantham is the latest one). |

Monday, March 17, 2014

Sunday, March 16, 2014

Saturday, March 15, 2014

Weekend Longform Links

My Life as a Retail Worker: Nasty, Brutish, and Poor - Joseph Williams - The Atlantic

The complete guide to listening to music at work – Quartz

"The Infinite Lives Of BitTorrent" http://rdd.me/yuvuueop via @readability

Are Malls Over? NYT

They come here, taking our jobs... Worried about immigration? Wait till I tell you about young people Newstatesment

"The Gavel Drops at Sotheby’s" http://rdd.me/ub1gwzjd via @readability

"Haiti’s Shadow Sanitation System" http://rdd.me/szkcjeue via @readability

"Nate Silver on the Launch of ESPN’s New FiveThirtyEight, Burritos, and Being a Fox" http://rdd.me/dm8cpnni via @readability

"Why We're Awful at Assessing Risk" http://rdd.me/qoxu7mjh via @readability

"An Investor’s Guide to Better Writing — Seriously" http://rdd.me/ddueuoar via @readability

"Missed Alarms and 40 Million Stolen Credit Card Numbers: How Target Blew It" http://rdd.me/t9p71ocx via @readability

"Reading reinvented for mobile era" http://rdd.me/04xfbtgc via @readability

"Technology: Rise of the replicants - FT.com" http://rdd.me/z6eicnuj via @readability

"The Story Behind the SAT Overhaul" http://rdd.me/rwvuwwgk via @readability

Billionaire Activist Steyer: Titans at the Table via @BloombergTV http://bloom.bg/1dMK8nQ

General Of The Army, Omar Bradley, January 23, 1981 (full): http://youtu.be/fDSrf3cosbo via @YouTube

Listened to Podcast Episode #25: Shane Parrish from The Web Psychologist » Blog @Stitcher http://www.stitcher.com/s?eid=32894783

Friday, March 14, 2014

FW: Banker’s bloat

| Wall Street bonuses are increasing again "GREED is good!" boomed Michael Douglas in the 1987 film "Wall Street." Though an anthem of the perceived excesses of the time, the bonuses then forked out to financiers were relatively meager: $32,000 on average. The sum would grow four-fold in the 1990s. And then it soared higher still, reaching a peak just before the financial crisis. In 2006 New York's investment banks paid nearly $40 billion in bonuses (adjusted for inflation)—about ten times the budget of the United Nations. During the crisis, banks had to show contrition and bonuses halved. But they have restarted their ascent. In 2013 the bonus pool of New York's financial-sector employees increased 15% to about $27 billion, as discussed in an item from this week's issue here.

|

Wednesday, March 12, 2014

Tom Sawyer and psychology

with the unenviable job of whitewashing his aunt’s fence in full view of his friends

who will pass by shortly and whose snickering promises to add insult to injury.

When his friends do show up, Tom applies himself to the paintbrush with gusto,

presenting the tedious chore as a rare opportunity. Tom’s friends wind up not only

paying for the privilege of taking their turn at the fence, but deriving real pleasure

from the task—a win–win outcome if there ever was one. In Twain’s words, Tom

“had discovered a great law of human action, without knowing it—namely, that in

order to make a man or a boy covet a thing, it is only necessary to make the thing

difficult to attain.”

via:DUKE

Tuesday, March 11, 2014

FW: Safe skies

| Despite a recent tragedy, air flights are getting safer THE disappearance of flight MH370, which lost contact with air-traffic control between Kuala Lumpur and Beijing, is a reminder of the dangers of air travel. Yet thankfully, such disasters are exceedingly rare. Over the past four decades fatalities on aeroplanes—be it from accidents or terrorism—have declined even as the number of travellers has increased almost ten-fold. Aviation is also much safer than other forms of transport. On a per passenger-mile basis, an individual is about 180 times more likely to die in a car than on a plane, according to America's National Safety Council (though these types of travel are not in direct competition). As for flight MH370, the mysteriousness is heightened because the aircraft vanished while cruising. It is a phase of flight that accounts for only 9% of fatalities but almost 60% of time spent in the air, according to the Aviation Safety Network, an independent database in the Netherlands.

|

Sunday, March 9, 2014

Wednesday, March 5, 2014

Six points from Man Searching for Meaning

1. “The one thing you can’t take away from me is the way I choose to respond to what you do to me. The last of one’s freedoms is to choose one’s attitude in any given circumstance.”

2. “Those who have a 'why' to live, can bear with almost any 'how'.”

3. “An abnormal reaction to an abnormal situation is normal behavior.”

4. “Life is never made unbearable by circumstances, but only by lack of meaning and purpose.”

5. “The attempt to develop a sense of humor and to see things in a humorous light is some kind of a trick learned while mastering the art of living.”

6. “We cannot, after all, judge a biography by its length, by the number of pages in it; we must judge by the richness of the contents...Sometimes the 'unfinisheds' are among the most beautiful symphonies.”

Via: GR

Tuesday, March 4, 2014

Monday, March 3, 2014

Polymath = success ?

I think we need to realize that we should all be targeting to be a polymath someday…

Rather like giving up the Economist podcast, this epiphany came as a sort of liberation. “The best thing is that I now idolise polymaths, people like da Vinci and Michelangelo,” he says. “They weren’t just engineers, they were artists and scientists, mathematicians and philosophers. They weren’t even experts in their own domain. Their genius lay in piecing things together.”

Via: FT

God Created the world - JP Morgan reorganized it

1901: J.P. Morgan announces that he is organizing the largest corporation the world has yet seen by merging his Federal Steel conglomerate with Andrew Carnegie’s Carnegie Co. The company is initially capitalized at $1.4 billion -- the first billion-dollar company ever -- four times the budget of the U.S. government and 7% of the gross national product. In a popular joke of the day, a schoolboy is asked about the history of the world. "God created the world in 4004 B.C.," he answers, "and it was reorganized by J.P. Morgan in 1901."

Source: Jean Strouse, Morgan: American Financier (Random House, New York, 1999), p. 404; John Steele Gordon, "The Business of America," American Heritage, June, 2001, p. 22.

Via:JS

Sunday, March 2, 2014

Stoicism: On Saving Time

Therefore, Lucilius, do as you write me that you are doing: hold every hour in your grasp. Lay hold of to-day's task, and you will not need to depend so much upon to-morrow's. While we are postponing,

life speeds by. Nothing, Lucilius, is ours, except time. We were entrusted by nature with the ownership of this single thing, so fleeting and slippery that anyone who will can oust us from possession. What fools these mortals be! They allow the cheapest and most useless things, which can easily be replaced, to be charged in the reckoning, after they have acquired them; but they never regard themselves as in debt when they have received some of that precious commodity, - time! And yet time is the one loan which even a grateful recipient cannot repay.

via: STOICS

Be the Distruptor

H/T : VIW

Notes from Buffett's 2008 Berkshire Letter

Take a look again at the 44-year table on page 2. In 75% of those years, the S&P stocks recorded again. I would guess that a roughly similar percentage of years will be positive in the next 44. But neither Charlie Munger, my partner in running Berkshire, nor I can predict the winning and losing years in advance. (In our usual opinionated view, we don’t think anyone else can either.) We’re certain, for example, that the economy will be in shambles throughout 2009 – and, for that matter, probably well beyond – but that conclusion does not tell us whether the stock market will rise or fall.

In good years and bad, Charlie and I simply focus on four goals:

(1) maintaining Berkshire’s Gibraltar-like financial position, which features huge amounts of

excess liquidity, near-term obligations that are modest, and dozens of sources of earnings

and cash;

(2) widening the “moats” around our operating businesses that give them durable competitive

advantages;

(3) acquiring and developing new and varied streams of earnings;

(4) expanding and nurturing the cadre of outstanding operating managers who, over the years,have delivered Berkshire exceptional results

Berkshire is always a buyer of both businesses and securities, and the disarray in markets gave us a tailwind in our purchases. When investing,pessimism is your friend, euphoria the enemy.

I made at least one major mistake of commission and several lesser ones that also hurt. I will tell you more about these later. Furthermore, I made some errors of omission, sucking my thumb when new facts came in that should have caused me to re-examine my thinking and promptly take action.

Additionally, the market value of the bonds and stocks that we continue to hold suffered a significant decline along with the general market. This does not bother Charlie and me. Indeed, we enjoy such price declines if we have funds available to increase our positions. Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

Our long-avowed goal is to be the “buyer of choice” for businesses – particularly those built and owned by families. The way to achieve this goal is to deserve it. That means we must keep our promises; avoid leveraging up acquired businesses; grant unusual autonomy to our managers; and hold the purchased companies through thick and thin (though we prefer thick and thicker).

Our record matches our rhetoric. Most buyers competing against us, however, follow a different path. For them, acquisitions are “merchandise.” Before the ink dries on their purchase contracts, these operators are contemplating “exit strategies.” We have a decided advantage, therefore, when we encounter sellers who truly care about the future of their businesses.

Reinsurance is a business of long-term promises, sometimes extending for fifty years or more. This past year has retaught clients a crucial principle: A promise is no better than the person or institution making it.

That’s where General Re excels: It is the only reinsurer that is backed by an AAA corporation. Ben Franklin once said, “It’s difficult for an empty sack to stand upright.” That’s no worry for General Re clients.

At that time, much of the industry employed sales practices that were atrocious. Writing about the period somewhat later, I described it as involving “borrowers who shouldn’t have borrowed being financed by lenders who shouldn’t have lent.”

Why are our borrowers – characteristically people with modest incomes and far-from-great credit scores – performing so well? The answer is elementary, going right back to Lending 101. Our borrowers simply looked at how full-bore mortgage payments would compare with their actual – not hoped-for – income and then decided whether they could live with that commitment. Simply put, they took out a mortgage with the intention of paying it off, whatever the course of home prices.

Just as important is what our borrowers did not do. They did not count on making their loan payments by means of refinancing. They did not sign up for “teaser” rates that upon reset were outsized relative to their income. And they did not assume that they could always sell their home at a profit if their mortgage payments became onerous. Jimmy Stewart would have loved these folks.

Commentary about the current housing crisis often ignores the crucial fact that most foreclosures do not occur because a house is worth less than its mortgage (so-called “upside-down” loans). Rather, foreclosures take place because borrowers can’t pay the monthly payment that they agreed to pay. Homeowners who have made a meaningful down-payment – derived from savings and not from other borrowing – seldom walk away from a primary residence simply because its value today is less than the mortgage. Instead, they walk when they can’t make the monthly payments.

Home ownership is a wonderful thing. My family and I have enjoyed my present home for 50 years, with more to come. But enjoyment and utility should be the primary motives for purchase, not profit.; the home purchased ought to fit the income of the purchaser.

The present housing debacle should teach home buyers, lenders, brokers and government some simple lessons that will ensure stability in the future. Home purchases should involve an honest-to-God down payment of at least 10% and monthly payments that can be comfortably handled by the borrower’s income. That income should be carefully verified. Putting people into homes, though a desirable goal, shouldn’t be our country’s primary objective. Keeping them in their homes should be the ambition.

“Back-tested” models of many kinds are susceptible to this sort of error. Nevertheless, they are frequently touted in financial markets as guides to future action. (If merely looking up past financial data would tell you what the future holds, the Forbes 400 would consist of librarians.)

Investors should be skeptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the symbols. Our advice: Beware of geeks bearing formulas.

However, I have pledged – to you, the rating agencies and myself – to always run Berkshire with more than ample cash. We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.

Clinging to cash equivalents or long-term government bonds at present yields is almost certainly a terrible policy if continued for long. Holders of these instruments, of course, have felt increasingly comfortable – in fact, almost smug – in following this policy as financial turmoil has mounted. They regard their judgment confirmed when they hear commentators proclaim “cash is king,” even though that wonderful cash is earning close to nothing and will surely find its purchasing power eroded over time.

Approval, though, is not the goal of investing. In fact, approval is often counter-productive because it sedates the brain and makes it less receptive to new facts or a re-examination of conclusions formed earlier. Beware the investment activity that produces applause; the great moves are usually greeted by yawns.

Weekend Linkfest

"Rolls-Royce Drone Ships Challenge $375 Billion Industry: Freight" http://rdd.me/vxed0tvz via @readability

"While the polar vortex freezes U.S. flights, Nordic airports make sport of defying the snow." http://rdd.me/6eoxjqa9 via @readability

"A Star in a Bottle" http://rdd.me/pksy0oqt via @readability

"Obama's Trauma Team" http://rdd.me/kgygy5ek via @readability

"We Are Less Than Rational" http://rdd.me/mdmdnb93 via @readability

Best Advice: Spot Bad Advice Early In Your Career | LinkedIn http://www.linkedin.com/today/post/article/20140225105559-249493-best-advice-spot-bad-advice-early-in-your-career …

Berkshire Letter 2013 http://www.berkshirehathaway.com/letters/2013ltr.pdf …

Open Strategist: Michael Porter on Value Based Healthcare {video} http://prashantkhorana.blogspot.com/2014/03/michael-porter-on-value-based-healthcare.html?spref=tw …

"Michael Steinhardt, Wall Street's Greatest Trader, Is Back -- And He's Reinventing Investing Again" http://rdd.me/1dytlqxe via @readability

"Twelve legendary investors on what to do with your money now" http://rdd.me/8ogbn0fv via @readability

El-Erian's PIMCO Resignation Memo - Business Insider http://www.businessinsider.com/el-erians-pimco-resignation-memo-2014-2 …

Oddball Stocks: Humility and knowledge http://www.oddballstocks.com/2014/02/humility.html?spref=tw …