Friday, February 28, 2014

FW: Obama's infrastructure plan is a lot smaller than he said it is

|

|

Wednesday, February 26, 2014

FW: Shorty’s long reach

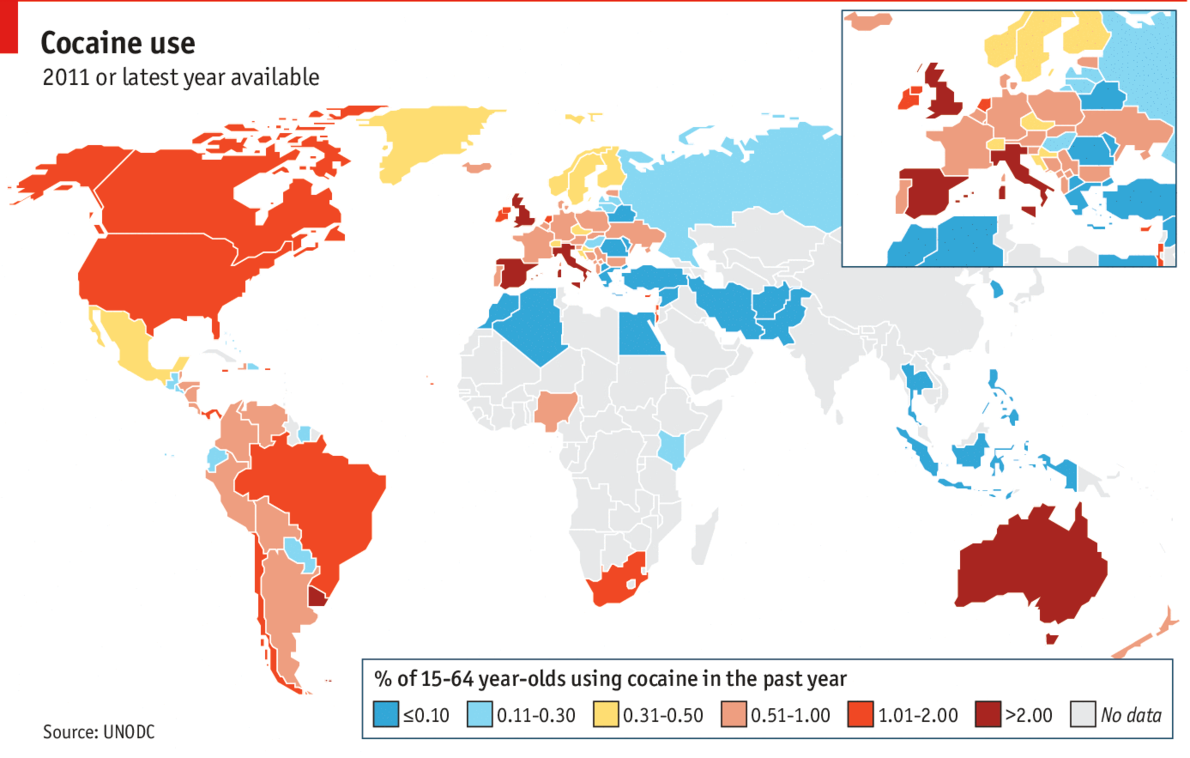

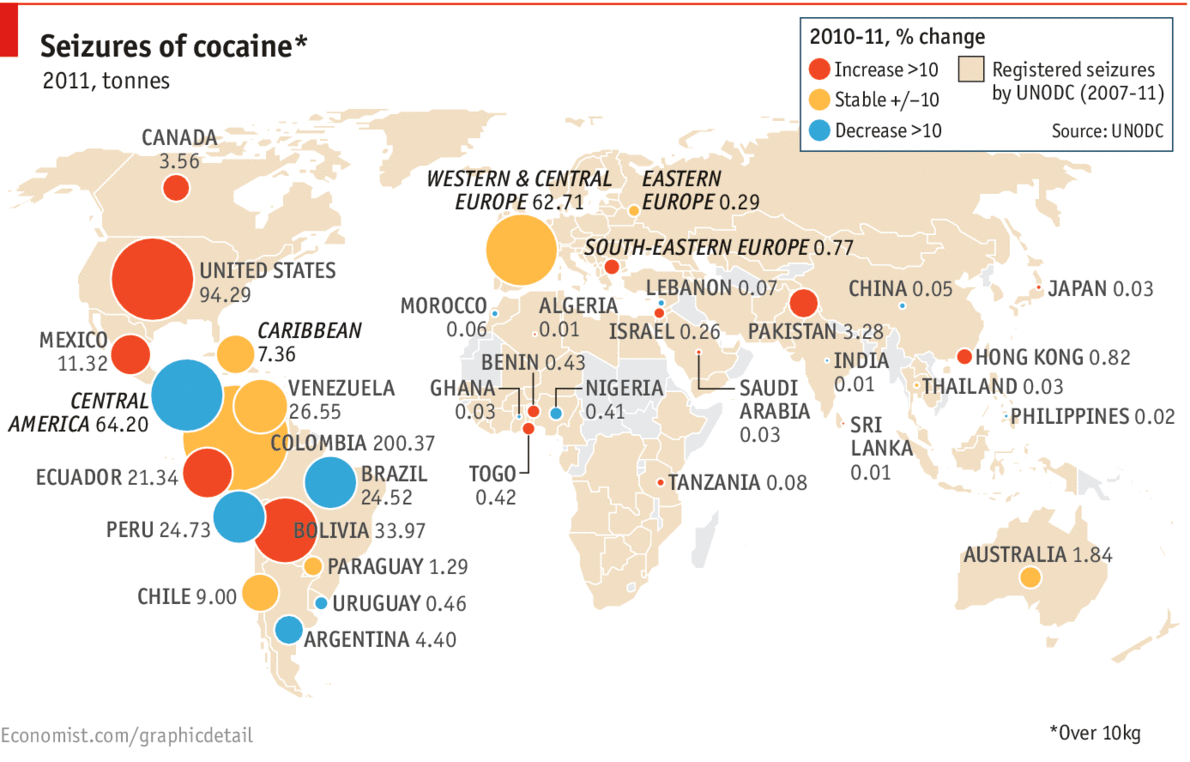

| How cocaine conquered the world HE MAY be only little, but Joaquín "Shorty" Guzmán, who was captured in Mexico on February 22nd, is reckoned to have run a big criminal business. Mr Guzmán, who spent 13 years on the run after escaping from prison hidden in a laundry cart, is said by prosecutors to have been the boss of the Sinaloa drug-trafficking organisation, reckoned to be the world's largest. "Cartels" such as Sinaloa have helped to create a global market for cocaine, whose active ingredient is grown only in remote parts of Bolivia, Colombia and Peru. In recent years police have seized the drug in nearly every country in the world. Though its popularity shows signs of declining in some rich countries, emerging markets such as Brazil are developing a taste for the drug.

|

Tuesday, February 25, 2014

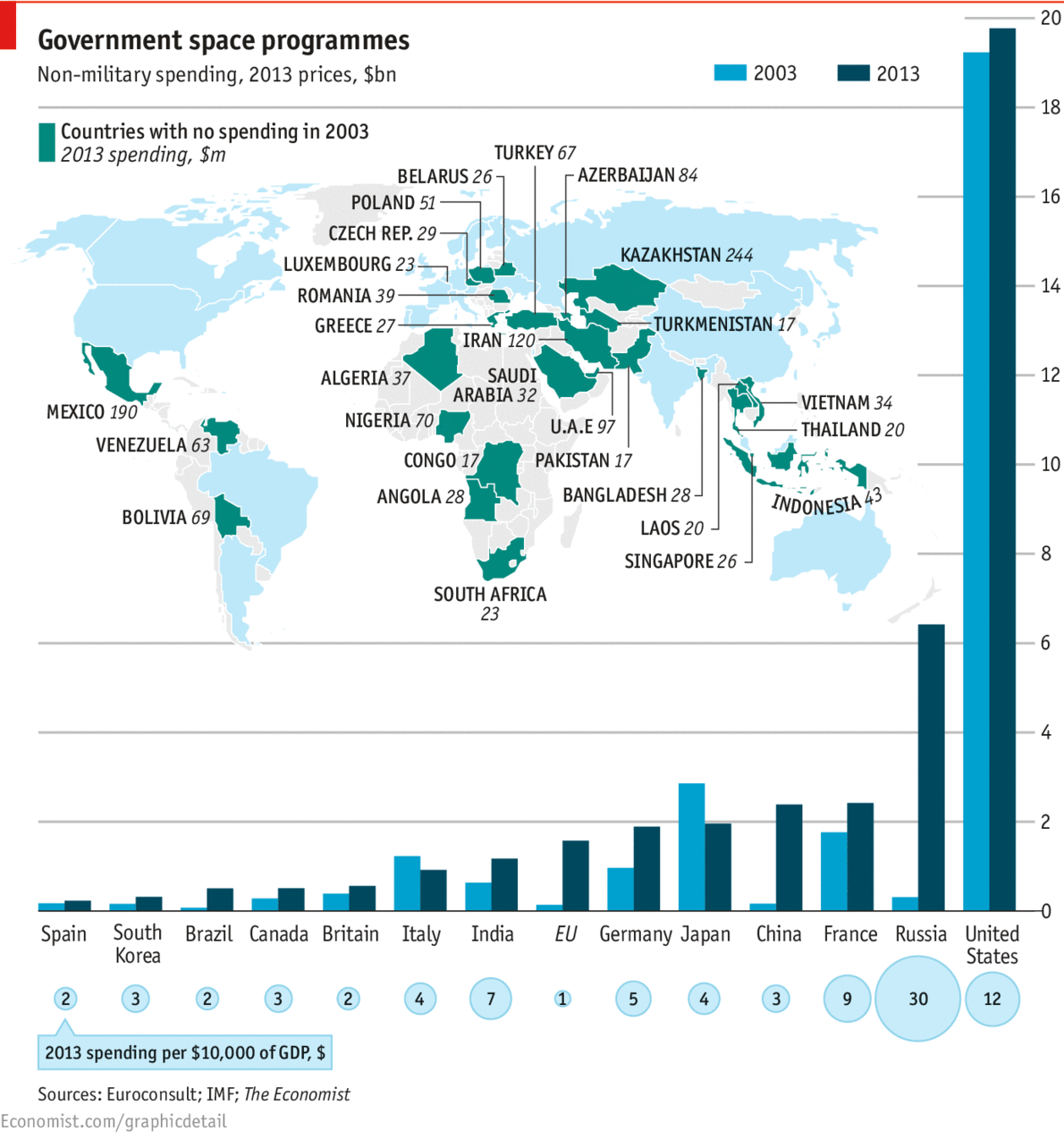

FW: Government Space Programs

Feed: The Big Picture

Posted on: Monday, February 24, 2014 22:00

Author: Barry Ritholtz

Subject: Government Space Programs

|

|

Sunday, February 23, 2014

Saturday, February 22, 2014

Top Quotes / Lessons from House of Cards

- "One heartbeat from the President and not a single vote cast in my name - democracy is so over-rated"

- "There is no sacred ground for the conquered"

- "I won't leave one of my own bleeding on the field"

- "Mr. Vice President, what you're asking for is just shy of treason." "Just shy. Which is politics."

- "I've always loathed the necessity of sleep, like death it puts even the most powerful men on their backs"

- “I don’t know whether to be proud or terrified. Perhaps both.”

- "If you don't like you the table is set - turn it over"

- "He's in the darkness now and I'm the only beacon of light. Now we gently guide him toward the rocks"

- "There is nothing more disgraceful than running from a battle"

- "Should have thought of this before. Appeal to the heart, not the brain"

- "Not everyone can be on the right side of history"

- "We'll put this behind us. Just like we've always done"

- "I don’t know whether to be proud or terrified. Perhaps both"

- "You’re connecting dots that don’t exist"

Friday, February 21, 2014

10 Weekend Longform Links

- The Ivory Business http://rdd.me/wvh8jwxy via @readability

- "36 Hours On The Fake Campaign Trail With Donald Trump" http://rdd.me/qrtrz6gf via @readability

- "Exclusive: The Rags-To-Riches Tale Of How Jan Koum Built WhatsApp Into Facebook's New $19 Billion http://rdd.me/iganqnes via @readability

- "Swiping Right in the 1700s" http://rdd.me/ueoapkxx via @readability

- "Scientology’s Vanished Queen" http://rdd.me/ellkp08v via @readability

- The Acid Trap - AEON http://rdd.me/g3gy3bqn via @readability

- "E-Cigarettes: A $1.5 Billion Industry Braces for FDA Regulation" http://rdd.me/0mioqupe via @readability

- "Baxter and the Second Machine Age" http://rdd.me/ywzwmeqm via @readability

- "The J.Crew Invasion" http://rdd.me/8brcfsen via @readability

- "In-N-Out's Burger Queen" http://rdd.me/ck5sqvhf via @readability

Thursday, February 20, 2014

FW: Apple, Google, Microsoft: Where does the money come from?

Feed: The Big Picture

Posted on: Tuesday, February 18, 2014 11:30

Author: Barry Ritholtz

Subject: Apple, Google, Microsoft: Where does the money come from?

|

|

Sunday, February 16, 2014

Linkfest

Lucy's Famous Chocolate Scene - YouTube http://www.youtube.com/watch?v=8NPzLBSBzPI …

FRB: Speech--Bernanke, The Ten Suggestions--June 2, 2013 http://www.federalreserve.gov/newsevents/speech/bernanke20130602a.htm …

More Reflection, Less Action - http://NYTimes.com http://dealbook.nytimes.com/2014/02/14/more-reflection-less-action/?_php=true&_type=blogs&_r=0 …

Robots, floods and the Kobayashi Maru | The Enlightened Economist http://www.enlightenmenteconomics.com/blog/index.php/2014/02/robots-floods-and-the-kobayashi-maru/ …

The Checklist Manifesto: How to Get Things Right http://www.farnamstreetblog.com/2014/02/the-checklist-manifesto/ …

Investing's Biggest Irony: Everyone Thinks They're a Contrarian http://www.fool.com/investing/general/2014/02/14/groupthink.aspx …

Oddball Stocks: A template for a perennial net-net: Alco Stores http://www.oddballstocks.com/2014/02/a-template-for-perennial-net-net-alco.html …

New York City's French Dual-Language Programs Are Mostly Pointless | New Republic http://www.newrepublic.com/article/116443/new-york-citys-french-dual-language-programs-are-mostly-pointless …

More and More Americans Think Astrology Is Science | Mother Jones http://www.motherjones.com/blue-marble/2014/02/public-opinion-astrology-dumb …

Jackie and John F. Kennedy by Mark Shaw. Hyannis Port, 1959. pic.twitter.com/1RtjZCvM4V

Shipping revival - graphic of the day | The Knowledge Effect http://blog.thomsonreuters.com/index.php/shipping-revival-graphic-day/ …

Cutting Loose – Aeon Film – 30 minutes http://aeon.co/film/cutting-loose/ …

What is love ? http://www.farnamstreetblog.com/

The 'House of Cards' effect: Why the British understand Washington better than Hollywood does http://theatln.tc/1bvZ7bC

“42 reflections on the meaning of life, the universe and everything” by @mrianleslie https://medium.com/meaning-meaningfulness/b973c7e565db …

The Economist explains: The science of love at first sight | The Economist http://www.economist.com/blogs/economist-explains/2014/02/economist-explains-6 …

Greatest Period In History IS Now - 50 Reasons by John Mauldin http://www.valuewalk.com/2014/02/greatest-period-in-world-history/ …

RSA Animate - Re-Imagining Work: http://youtu.be/G11t6XAIce0 via @youtube

Saturday, February 15, 2014

Thursday, February 13, 2014

FW: Empire building[infographic]

| The expansion of Lego

FEW toy brands are as ubiquitous as Lego. The Danish brickmaker reckons that, on average, every person on earth owns 86 Lego bricks. By 2017 Lego men are expected to outnumber humans. The little bricks are big business. Despite having only one type of toy to tout, Lego has gone from being a small, loss-making firm a decade ago to the world's second-biggest toymaker. In the 1990s growth slowed as children became increasingly glued to their computers. Lego has fought back by embracing the new media, diversifying into television, video games and, now, film. "The Lego Movie", released in America on February 7th, took $70m at the US box-office over its first weekend. Though the film's storyline is somewhat anti-commerce (the villain is called President Business), Lego is doing rather nicely: in the past five years its profits and number of employees have doubled, albeit from a low base. Building on other successful blockbuster franchises has also helped bring in money. In 1999 sales of the first wave of Lego Star Wars toys were six times greater than the company...Continue reading |

Wednesday, February 12, 2014

Linkfest

- Oddball Stocks: Business is complex http://www.oddballstocks.com/2014/02/business-is-complex.html …

- Nations Ranked by Quality of Life | The Big Picture http://www.ritholtz.com/blog/2014/02/nations-ranked-by-quality-of-life/?utm_source=dlvr.it&utm_medium=twitter …

- 9 Simple Things Great Speakers Always Do - Business Insider http://www.businessinsider.com/9-simple-things-great-speakers-always-do-2014-2 …

- Talent Is Persistence: What It Takes To Be An Independent Creative - 99U http://99u.com/articles/20490/talent-is-persistence-what-it-takes-to-be-an-independent-creative …

- The European Commission: Lagarde for president | The Economist http://www.economist.com/news/leaders/21595904-if-ever-europe-needed-competent-reformer-new-ideas-it-now-lagarde-president …

- The 33 Worst Things That Could Happen On Valentine's Day http://www.buzzfeed.com/leonoraepstein/worst-things-that-could-happen-on-valentines-day …

- The Economist explains: Why Indians love cricket | The Economist http://www.economist.com/blogs/economist-explains/2014/02/economist-explains-1 …

- Let's brew some tea: Lake Tea http://what-if.xkcd.com/79/

- Lessons From The Samurai: The Secret To Always Being At Your Best - Business Insider http://www.businessinsider.com/lessons-from-the-samurai-the-secret-to-always-being-at-your-best-2014-2 …

- Finland Has A Shyness Problem - Business Insider http://www.businessinsider.com/finland-has-a-shyness-problem-2014-2 …

- Oddball Stocks: How to become a better investor http://www.oddballstocks.com/2014/01/how-to-become-better-investor.html

Tuesday, February 11, 2014

FW: The power of algorithms? Upworthy traffic is down 46% in two months

|

|

Monday, February 10, 2014

FW: Beefed up

| The Vietnamese Dong joins our Big Mac index

TRAFFIC was heavier than normal in Ho Chi Minh City on Monday February 10th as McDonald's opened its first branch in Vietnam. Mostly motorbikes queued in the new "drive-thru", while hundreds waited under the golden arches and Ronald McDonald posed with customers. The opening allows us to add the Vietnamese Dong to our Big Mac index, our light-hearted guide to currencies. It is based on the theory of purchasing-power that in the long run exchange rates should move to equalise the price of an identical basket of goods and services in two countries. Our basket contains only one good, a Big Mac burger. Since a Big Mac costs 60,000 Dong, or $2.84 at market-exchange rates, compared with $4.62 in America, our index suggests the Dong is undervalued by 39% against the dollar. The currency, which is loosely pegged to the dollar, has been stable since June when the country's central bank depreciated it by 1% against the dollar to help improve the balance of payments. Keeping the exchange rate low has helped boost exports. Vietnam's trade balance turned back...Continue reading |

Review - The Firm: The story of Mckinsey

- The original consultants at McKinsey were 'management engineers' not high flying MBA's - this might highlight the fact that at one point in time, process improvement by engineers was the key function of a consultant

- By definition, you improvise in battle, and he who improvises best wins - Although he was one of the firm’s first champions of a strategy practice, Ohmae became famous for his later repudiation of the idea of formal corporate strategy—arguing a variant of Prussian general Helmuth von Moltke’s dictum that all strategic plans become nullified on first contact with the enemy.

- Perhaps searching for problems that fit your toolbox isn't the best idea; instead you should search for problems that need solving - We need a conceptual supernova, a direct response to BCG’s matrix. That was exactly what we didn’t need. We want to help our clients solve the problems they have, not the problems we know how to solve. We don’t want to be a solution in search of a problem, and that’s what the four-box matrix was. That’s what the experience curve was. Sometimes they worked. And sometimes they didn’t.

- McK has both generalists and specialists - In arguing that the firm needed both “snowball makers” (specialists) and “snowball throwers” (generalist rainmakers), he said, “Every McKinsey consultant needs to be a generalist, but it’s not necessarily a handicap to know what you’re talking about.” He later added, “Would you want your brain surgery done by a general practitioner just in what McKinsey knew but in who at McKinsey knew these subject areas. An unstated understanding emerged that if you were a logistics expert in, say, the retail sector and you were called by a partner you had never met who mainly did work with pharmaceutical companies, you would nevertheless return the call. That reputation for contributing was your asset in the firm.

- McK ruthlessly focuses on structured thinking, something that not everyone appreciated - Peters and Waterman were suggesting that the secrets to success were not necessarily quantifiable, that they might be impervious to rigorous analysis. They talked of focusing on the customer and on the employee, not just on org charts and spreadsheets.Whereas before, Peters and Waterman had been talking about a range of topics—from people to involvement, trust, listening, and wandering—with this new insight, the ideas now slid off the tongue: skills, staff, style, systems, structure, shared values, and strategy. (And propagating a tradition that has become accepted in most consulting circles but definitely within McKinsey: Every idea needs an odd number of bullet points to be explained.)

- Tom Peters left the firm with a not so amicable relationship - Peters still has a testy relationship with the firm. “McKinsey has a stratospheric belief in itself,” he has said. “If intellectual arrogance had not yet been invented,” he continued, “it would have been invented for that crew. But let me tell you this: I am sixty-seven years old, and I have had the luck of God smile on me, but I am still scared shitless of McKinsey people.”29 The firm even found a way to needle him in its privately published internal history. “There’s a caption under a picture of me that made me laugh hysterically,” he said. “I am described as undisciplined but brilliant. I have no problem with ‘brilliant,’ but ‘undisciplined’ made me turn purple in the face. You don’t write sixteen books, give three thousand speeches, and work eighteen hours a day for thirty years and be undisciplined. It’s typical fucking McKinsey. Why do you need to say things like that?”(A McKinsey partner responded: “He just said it. Three thousand speeches and sixteen books is exactly what we meant. He’s undisciplined. He should have focused on two clients and one book.”)

- People at the firm learn from the partners, clients are good enough - Not surprisingly, the consultants exhibited a renewed confidence that occasionally veered right into arrogance. “There are only three great institutions left in the world: The Marines, The Catholic Church, and McKinsey,” one partner told BusinessWeek in 1986.48 London office manager Peter Foy suggested, “There is no institution on the planet that has more integrity than McKinsey and company.” In a Forbes article, a McKinsey partner summed up the self-image neatly: “We don’t learn from clients. Their standards aren’t high enough. We learn from other McKinsey partners.”

- Few clients are going to hire McKinsey and then say the consultants weren’t worth it - In a sense, the firm is a spiritual relative of “La Belle” Otero, a courtesan living in Paris in the early part of the twentieth century who was once considered the most sought-after woman in the world. Carolina Otero was very selective about her clientele and charged outrageous fees that reportedly topped $1 million in 2012 dollars. Her customers included Prince Albert I of Monaco and the king of Serbia, and it was widely argued that everybody who had the means had to have her at least once. And once you’d done that, what could you say? Once you’d paid a million francs for a roll in the hay, you weren’t about to admit it wasn’t worth the price paid.

- McKinsey’s work for General Motors in the early 1980s showed quite clearly that consultants can sometimes do far more harm than good to a company, even if it’s one of the most important clients they might ever have. At the time, General Motors—the Titanic of American business—was being pummeled by Japanese carmakers like Toyota. Chairman Roger Smith decided in 1984 to embark on the most massive reorganization of a company in American history.

- McKinsey interviewed the top sixty-five executives in the company and eight hundred employees, asking them what organizational problems they saw. With their poll results in hand, the consultants proposed a new structure. Instead of organizing the company by brand—Chevy, Cadillac, Buick, et cetera—the consultants said it should be organized by type of car—large, small, truck. This was a basic McKinsey maneuver—don’t organize around this, organize around that—and it had worked in the past. The consultants had successfully helped AT&T organize around its markets as opposed to its technologies, for example. But it was not the right prescription for GM.

“Only later did people begin to realize that it wasn’t the fact that the Japanese had a compliant low-paid workforce that got up every day and sang the Toyota hymn.t was that they built cars with fewer parts, fewer defects, continuous improvement processes, and took man-hours out of making cars without compromising productivity. I’m 100 percent sure McKinsey had no clue about these revelations.” - Instead, McKinsey just moved people around, and this had the effect of destroying institutional knowledge and the informal networks of people who knew how to get things done inside the massive company. “They were flying perpendicular to where they should have been,” said Keller. “It was the thousands of little things Toyota did well that mattered, not the organizational design of General Motors.”

- The Prussians beat the French in 1871, but not because they had inspired leadership.

- They won because their system was based on rules, orders, and norms that allowed their army to run efficiently and without the need for heroes. Likewise, Industrial Prussianism skips the heroes and focuses on efficiency and frugality, with training and accountability. The only point of strategic planning is to think through all contingencies in advance so as to make fewer tactical execution errors; he who makes the fewest and has the best-organized and best-trained troops wins. The companies that survive, like the best armies, can recover from unexpected blows of fate and competitor breakthroughs.

- Even today, the best consultants are ex-engineers, not perfectly designed social operators with a Harvard MBA. Engineering teaches you to define your solution space, determine the relevant levers you can pull or push, and then find your solution. Strategize all you want, but if your processes aren’t well oiled, you’re a goner.

- McKinsey can also be hired when one executive needs “disinterested” support for an idea that might just also result in the removal of an internal rival. Lee Iacocca wrote in his autobiography that when Henry Ford wanted Iacocca out of the firm, he hired McKinsey to recommend a new organizational structure. Iacocca went to Chrysler, where he used Bain & Company instead of McKinsey.

- Gupta stood for one more thing: the end of the firm’s ambivalence about making money

Gupta was clearly the man to put a halt to what he considered to be money-wasting research. In his twenty-one years at the firm, he had contributed a sum total of zero articles to McKinsey’s knowledge-management system. “He may have said he respected our knowledge building,” continued the partner, “but actions speak louder than words.” - You can't beat culture - McKinsey had to make other adjustments in China. Throwing young Harvard MBAs into the fire by making them present to CEOs so soon after being hired wasn’t prudent in a hierarchical society that values age and experience over youthful promise. This wasn’t a new issue for the firm: In the 1980s, when he was managing director, Ron Daniel had one meeting with the parents of a prospective Japanese recruit in which he had to reassure them that their young son was not being sold into some sort of modern slavery. “Asians venerate age,” he explained. “We tend not to.”

- “Never underestimate the lemming-express effect that obtains among students at ‘top’ business schools and colleagues,” wrote author Walter Kiechel. “You compete to get into the most prestigious college. Then you compete to get into the top-ranked business school. After you’ve learned and displayed so much independence of mind, what’s left but to compete to be hired by the employer all your peers were clamoring to join?

ON ENRON:

One: The firm endorsed Enron’s asset-light strategy. In a 1997 edition of the Quarterly, consultants wrote that “Enron was not distinctive at building and operating power stations, but it didn’t matter; these skills could be contracted out. Rather, it was good at negotiating contracts, financing, and government guarantee—precisely the skills that distinguished successful players.” - Two: The firm endorsed Enron’s “loose-tight” culture. Or, more precisely, McKinsey endorsed Enron’s use of a term that came straight out of In Search of Excellence. In a 1998 Quarterly, the consultants peripherally praised Enron’s culture of “[allowing executives] to make decisions without seeking constant approval from above; a clear link between daily activities and business results (even if not a P&L); something new to work on as often as possible.”

- Three: The firm endorsed Enron’s use of off–balance-sheet financing. In that same 1997 Quarterly, the consultants wrote that “the deployment of off–balance-sheet funds using institutional investment money fostered [Enron’s] securitization skills and granted it access to capital at below the hurdle rates of major oil companies.”

- On Jeff Skilling: Jeff Skilling’s presentation on how he had turned an energy company into a financial company. “All anyone was talking about was how dazzling Skilling was,” said the ex-partner. “The analytics he showed! Everyone was having little orgasms in the elevator! The whole episode raised three very important questions. First, did McKinsey stray from its core values by effectively hyping Enron during the fraudulent rise? Second, was the firm liable for any of Enron’s misdeeds? And third, would other clients care? The short answers: Yes, No, and No.

- The firm imposed up-or-out on everyone - In 2007 the firm advised Walmart that the cost of an “associate” with seven years of tenure was almost 55 percent more than the cost of one with just a single year of tenure, but there was no difference in their productivity. Beyond the obvious offensiveness of suggesting Walmart lay off its experienced and loyal staff in favor of cheap new labor, this was up-or-out all over again. McKinsey could push its system even in a place like Walmart.

- Charlie Munger, Warren Buffett’s longtime partner at Berkshire Hathaway, wrote in his book Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger that he had never met a corporate leader who’d actually read a consulting report.

- Pin executives down, and they will surely be able to tell you about the most important decisions of their career. In a large organization, though—the kind for which McKinsey works—the value of most decisions doesn’t necessarily reside in the actual choice made; it resides in the very fact that the choice is being made in the first place. Leadership is about getting people to follow you, but before they can do that you need to choose the direction in which you’re heading. There will always be demand for such a service, and that’s precisely what McKinsey provides.

Sunday, February 9, 2014

Things i learned while studying for the GRE/GMAT

- Your spirit will break before your body(as Bane from Batman said) - You will feel tired, frustrated and emotional on the days you don't make any progress; most of this will be psychological

- Your vocabulary will surpass the average of individuals you work with for the most part - You will notice this as you write emails at work; albeit, this will rely heavily on how much of an avid reader you are. If you don't read quality journalism everyday, you will forget the words you learned

- If you're learning another language, you will immediately notice the overlap and realize the extent to which English is infested with words from other language

- You will realize the difference between abstract thinking and logical thinking - being a math major, it was shocking to notice that I performed poorly in the quantitative section for the first few times since I was taking everything with a theoretical bent

- Your ability to sit still for hours will skyrocket - a feat almost impossible to achieve in this ADD inducing, social media filled world

- You will know fundamental geometry, algebra and mathematical series like the back of your hand - although the value of this is dubitable, this might prove to be useful if you work in a quantitative field

- You will find it much easier to scrutinize small grammatical errors in email other people write at work - which will be a pet peeve

- You will become a pedant - yes, I just did it. People will often say - 'speak English'

Saturday, February 8, 2014

Weekend Longform Links

- Finland Has A Shyness Problem - Business Insider http://www.businessinsider.com/finland-has-a-shyness-problem-2014-2 …

- Howard Stern "The Last Days of Howard Stern" - Comedians In Cars Getting Coffee by Jerry Seinfeld http://comediansincarsgettingcoffee.com/howard-stern-the-last-days-of-howard-stern#.UvbQV3787j0.twitter …

- In the SAC Saga, It’s Hard to Chase a Shadow http://nyti.ms/1aHZrDz

- "Our Interview With Jeopardy! Champion Arthur Chu" http://rdd.me/nghuahka via @readability

- NASA’s mission: Its search for meaning has limited its science and damaged its integrity. http://slate.me/1f4mjJi

- Carl Icahn 2.0: an icon of '80s greed is back to shake up Silicon Valley | The Verge http://bit.ly/1f4lxfm

- The Seeds of a New Generation http://nyti.ms/1f4l1xS

- For Many Older Americans, an Entrepreneurial Path http://nyti.ms/1fSPvXA

- Ezra Klein on His New Vox Media Venture -- New York Magazine http://nym.ag/1dxye11

- The Epicurean Dealmaker: Even Cowgirls Get the Blues http://bit.ly/1dxxfhl

- Secrets of Ivy League Tour Guides, Princeton University Narratively - Narratively: Human stories, boldly told.: http://www.narrative.ly/campus-chronicles/secrets-of-ivy-league-tour-guides/ …

- Paris Review – A History of the Quaalude, Jordan Belfort’s Drug of Choice, Angela Serratore http://www.theparisreview.org/blog/2014/01/28/free-of-ones-melancholy-self/ …

- Teddy Roosevelt’s 10 Rules for Reading | BOOK RIOTTeddy Roosevelt's 10 Rules for Reading - BOOK RIOT http://bit.ly/1fLIib7

- Satya Nadella email to employees on first day as CEO http://bit.ly/MXuIrN

- Twelve legendary investors on what to do with your money now - The Globe and Mail http://www.theglobeandmail.com/report-on-business/rob-magazine/invest-like-a-legend/article16555294/ …

- Life as a Nonviolent Psychopath - Health - The Atlantic http://www.theatlantic.com/health/print/2014/01/life-as-a-nonviolent-psychopath/282271/ …

- 100 Tips About Life, People, and Happiness — Writing, Thinking, and Opinions — Medium https://medium.com/philosophy-logic/1511c6765ff9 …

- Skip the Organic Aisle. Conventional Produce Is Good for Your Kids. http://www.slate.com/articles/double_x/the_kids/2014/01/organic_vs_conventional_produce_for_kids_you_don_t_need_to_fear_pesticides.html … via @slate