- The Private Side of Christopher Hitchens: Photos From His Wedding and Beyond - Slate Magazine http://bit.ly/PIpugy

- Lobster prices are collapsing, but market-price lobster meals aren’t getting any cheaper. - Slate Magazine http://bit.ly/MNinDZ

- August 22, 1969: The Beatles' Final Photo Shoot | Brain Pickings http://bit.ly/MMzjKL

- Hire Introverts - Susan Cain - The Atlantic http://bit.ly/MOHWEx

- Nothing to Hide: Why Restaurants Embrace the Open Kitchen | Business | TIME.com http://bit.ly/MOPU0w

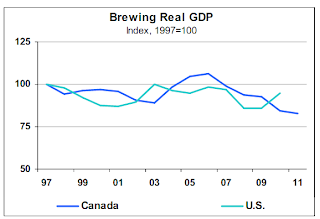

- Fishing Lodge Indicator | Dynamic Hedge http://bit.ly/MOQ5ci

- Letters to a Young Trader | Dynamic Hedge http://bit.ly/MORXl5

- Tootsie Roll's Secret Empire http://bit.ly/Pf6Dau

- Best Olympics Photos From London 2012 - Business Insider http://bit.ly/Pf6LqI

- 18 Rules of Living by the Dalai Lama - StumbleUpon http://bit.ly/MPD5TD

- NASA’s Curiosity Rover Gets Moving on Mars http://bit.ly/PjoCN2

Saturday, August 25, 2012

Links

Time Portal Fallacy

In reality the trade might take several paths and some of them may prove to be bumpy with M2M volatility, which may be fine to ignore in some cases, but not in others.

The problem with such trades isn’t the ultimate hypothesis, but the fact that there might be several paths to it. The US government defaulting might surely be difficult to imagine, but it’s not too hard to imagine the market temporarily implying a significant chance of it happening and that being built into the pricing of the CDS tranche and thus demanding high premia because of the noise traders make which would impact the PnL of the trade and squeeze some people out. This behavior isn’t new though, Keynes noted back in 1932 that “the market can stay irrational longer than you can stay solvent”.

AIG was widely publicized a few years ago for selling protection on CDOs. AIG repeatedly claimed that the portfolio of CDS was safe on a held-to-maturity basis, but it never mentioned the impact of variances in the fair value of the CDOs which eventually pushed it to the brink of bankruptcy.

Thursday, August 23, 2012

Links

Wednesday, August 22, 2012

Leadership Quotes from Bane[Dark Knight]

CIA Agent: At least you can talk. Who are you?

Bane: It doesn't matter who we are, what matters is our plan.

Bane: Theatricality and deception, powerful agents for the uninitiated. But we are initiated, aren't we Bruce?

Bane: Oh, you think darkness is your ally. You merely adopted the dark; I was born in it, moulded by it. I didn't see the light until I was already a man, by then it was nothing to me but BLINDING!

Bruce Wayne: Where am I?

Bane: Home, where I learned the truth about despair, as will you. There's a reason why this prison is the worst hell on earth... Hope. Every man who has ventured here over the centuries has looked up to the light and imagined climbing to freedom. So easy... So simple... And like shipwrecked men turning to sea water from uncontrollable thirst, many have died trying. I learned here that there can be no true despair without hope.

Source: IMDB

Links

· Blackberry's secret weapon? Let me guess, there is a self destruct button? http://bit.ly/PbwQ9M

· The Almighty Dollar (Raw Image) http://bit.ly/ozkGfo

· BBC News - Afghan rocket attack damages US army chief plane http://bit.ly/MJ1sm3

· BBC News - Afghan rocket attack damages US army chief plane http://bit.ly/MJ1sm3

· Did Monica Lewinsky Really Save Social Security? | History News Network http://bit.ly/PcDOvd

Tuesday, August 21, 2012

Monday, August 20, 2012

Productivity Links

· 10 Things Your Customers Wish You Knew About Them [Infographic] | The Buffer blog: productivity, life hacks, writing, … http://bit.ly/P952Ts

· 7 Habits of Web-Savvy Entrepreneurs http://bit.ly/N9i9kZ

· 10 Weekly Ten Minute Practices to Boost Work Productivity http://bit.ly/wW764r

· 10 Bad Habits You Need to Break to Be More Productive | Time Management Ninja http://bit.ly/OCIA3X

· » How to be Insanely Productive and Still Keep Smiling :zenhabits http://bit.ly/OqStVm

Sunday, August 19, 2012

A poker player on Return on Equity

But not only is Einhorn known for his value investing skills, but also for his poker skills, which makes his story very interesting. But are investing and poker similar? Is gambling and investing the same thing? Is winning at investing and gambling purely based on luck? “Not really” says Einhorn, “but sample size matters. Over time, and over thousands of hands against a variety of players, skills win out”.

But let’s get to Einhorn’s opinion on Return on Equity (ROE) today. According to him, there are essentially two types of businesses:

Capital intensive ones and non-capital intensive ones. A capital intensive business is one which requires capital to grow, for example, to build another plant, a manufacturing facility of some sort etc.

Non-capital intensive businesses are those that do not require capital or physical resources to grow. These businesses grow based on intellectual capital and human capital. Examples would be, pharmaceutical companies (which rely on their patents to generate revenue), software firms (which rely on the software they built to generate revenue) and consulting firms (which rely on their people to generate revenue). Most other companies that sell services would qualify as well here.

Einhorn points out that it is irrelevant to worry about ROE for non-capital intensive businesses. If a consulting firm had twice as many desks and office locations, it wouldn’t really mean that per consultant revenue would double, especially considering they travel to client sites to advise them; it would be redundant to add such resources.

It follows from this that the price-to-book value ratio is irrelevant for such companies because they derive their value from brand equity, intellectual and human capital which is not reflected on the balance sheet.

But for these companies, the question becomes ‘what to do with the spare cash?’

They could return the cash generated to the shareholders or do something a lot worse, enter capital-intensive businesses.

Take for example, the infamous ‘investment bank’. Investments banking advisory services are wonderful non-capital intensive businesses. Fee is paid to these banks for their advice and the only important asset is the people who go up and down the elevator.

But once they start lending money to investors, they become a little capital intensive. Then they enter into PE and other illiquid areas and become even more capital intensive. And before you know it, they turn into capital intensive businesses. And the irony is that everyone else is coming to these banks for advice on how to create more shareholder value while these banks themselves dilute their own ROE with capital-intensive activity.

But this doesn’t mean non-capital intensive businesses are always excellent ‘BUYS’. Their high returns attract new entrants and competition ends up driving down the ROE.

Investing based on ROE can be tricky, but David’s point above is definitely worth considering. So what are you investing in, capital intensive or non-capital intensive businesses?

Friday, August 17, 2012

Links

· Goldman sachs | Five years on ... is it really that bad? http://bit.ly/Ppaemz

· Michigan Begs for $100,000 Engineers After Auto Rebound - Bloomberg http://bit.ly/N0sSFe

· Goldman Sachs Said to Cut More Than 20 in Sales, Trading - Bloomberg http://bit.ly/PpsOLz

· How Harvard is failing its students « mathbabe http://bit.ly/P1WAVZ

· Subway etiquette: applying makeup on the 1 train « mathbabe http://bit.ly/RlY5UO

· Are We All Braggarts Now? http://bit.ly/RlYkiM

· Punishing Cheaters Promotes the Evolution of Cooperation | The Primate Diaries, Scientific American Blog Network http://bit.ly/P1Zvy1

· Abby Joseph Cohen Themes And Risks - Business Insider http://bit.ly/RlYK90

· Down With Shareholder Value http://bit.ly/Or4RBn

· Library Booklists: Adult Fiction: Financial Fiction http://bit.ly/Or4U00

· Where Are You in the Economic Strata? | The Big Picture http://bit.ly/OqYxtM

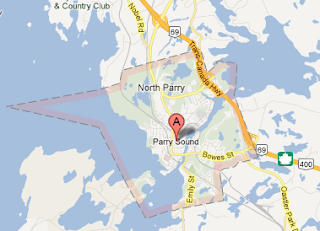

Taking a break and heading to a beautiful little place called Parry Sound for the weekend. See you all next week!

Thursday, August 16, 2012

Links

· No Alpha: Bain Capital’s Investment Results | The Big Picture http://bit.ly/MZTEh9

· Jim O'Neill's Complete Outlook For The Global Economy And Financial Markets [Slide Deck] - Business Insider http://bit.ly/LdgfAt

· Paying With Square, You'll Want To Ditch Your Credit Card Forever - Business Insider http://bit.ly/MXYWcO

· Special Report - China's answer to subprime bets: the Golden Elephant| Reuters http://bit.ly/MXdb1H

Wednesday, August 15, 2012

Links

· Reddit Users Share 25 Ways To Make Your Life Easier - Business Insider http://bit.ly/MTpSug

· This Harvard Alum Barely Survived College - Business Insider http://bit.ly/MVprzz

· The Five Biggest Myths About Saving Energy in the Summer http://bit.ly/Nu91KW

· How to Brand Yourself [infographic] http://bit.ly/PiVXYC

· 5 Graphs That Show How Crazy It Is to Compare California to Greece - Jordan Weissmann - The Atlantic http://bit.ly/OVsun2

· The 100 Greatest Movie Insults of All Time - YouTube http://bit.ly/MVlevU

· Mars Looks Quite Familiar, if Only on the Surface http://bit.ly/OVs3ZY

Monday, August 13, 2012

Links

· The Secret to Solar Power http://bit.ly/OTcrpL

· Goldman Sachs Leads Split With Obama, as GE Jilts Him Too - Bloomberg http://bit.ly/MPFGOI

· The most curious inventions this summer | A Patent for What?: Something for Everyone - Bloomberg http://bit.ly/ORE7eR

· Autism Speaks NYSE Party - Business Insider http://bit.ly/OQMzLc

· 12 Things Killer Employees Do Before Noon - Business Insider http://buff.ly/OXBhW2

· World’s Richest Gain $7.2 Billion as Buffett Ousts Ortega - Bloomberg http://bit.ly/OQxLfK

· 34 People You Probably Didn't Know Were On Seinfeld http://bit.ly/OC9n1G

Saturday, August 11, 2012

Friday, August 10, 2012

Links

Thursday, August 9, 2012

Wednesday, August 8, 2012

Links

· Economic History Stories http://bit.ly/MyjcS4

· The Economics of the Olympics, David Henderson | EconLog | Library of Economics and Liberty http://bit.ly/Myf70m

· Austerity At The Olympics: Each "Gold" Medal Contains 1.34% Gold | ZeroHedge http://bit.ly/Q0jOyL

· Please Explain Your Rationale For The Rainbow Cover Letter- Business Insider http://bit.ly/MtUYbJ

· LinkedIn Blog » LinkedIn’s Monster 89% Revenue increase | http://bit.ly/MmZQPQ

· Who Caused The Financial Crisis - Business Insider http://bit.ly/Mt0prt

· The Reverse Psychology of Temptation - Peter Bregman - Harvard Business Review http://bit.ly/PBzVOE

· Video - Olympic Level Rowing With the Winklevoss Twins - WSJ.com http://bit.ly/PBAMPm

· Study: Many Americans die with ‘virtually no financial assets’ - MIT News Office http://bit.ly/OLacHY

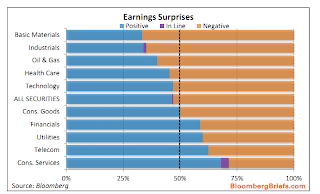

US pension plans[chart]

Ironic that a company that specializes in benefits and pensions would have the worst funded pension plan.

Via: Reuters

Tuesday, August 7, 2012

Links

· FT Alphaville » Ye olde (ironic) collateral crunch[Amsterdam1763] http://bit.ly/PvRz6w

· Why Top Young Managers Are in a Nonstop Job Hunt - Harvard Business Review http://bit.ly/M6pes9

· Daily chart Olympics: Going flat out | The Economist http://bit.ly/MpQGSH

· Disrupting The MBA Loan Market | Poets and Quants http://bit.ly/MqLOMY

· RT @StanfordBiz: What a $100,000 MBA Loan Paid Back Over 15 Years Would Cost: Federal Loan vs. @SoFi - http://bit.ly/MsN1Du

· Amazon's New Secret Weapon: Delivery Lockers http://bit.ly/MsOqtZ

· Jenna Jameson on Mitt Romney|"There’s nothing more American, I think, than screwing people you don’t know for money" http://bit.ly/MoST0E

· The Porn Convention - Forbes http://bit.ly/MpBqW3

· VIDEO: Serena Williams Completed The Career Golden Slam And Then Did The C-Walk [VIDEO] - Business Insider http://bit.ly/Pvixev

· Chick-fil-A Day a Reminder That Boycotts Often Backfire - Bloomberg http://bit.ly/OxspZj

Saturday, August 4, 2012

Links

Friday, August 3, 2012

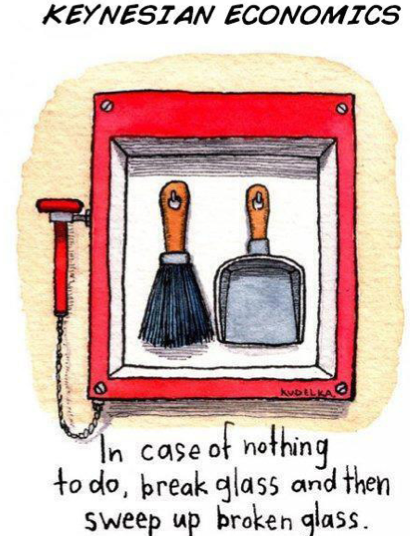

FW: Keynesian Economics

Feed: The Big Picture

Posted on: Friday, August 03, 2012 2:01 PM

Author: Barry Ritholtz

Subject: Keynesian Economics

I tend to like the idea of Keynesian counter-cyclical spending, but I have to admit this is amusing: Hat tip Grant Williams, Things That Make You Go Hmmmm. |

Thursday, August 2, 2012

Links

· Apple CEO Tim Cook Likes These 7 Beautiful Things - Business Insider http://bit.ly/OApMDJ

· Questioning El-Erian | Felix Salmon http://bit.ly/M9vU3A

· Q&A: The Gourmand Behind New York's $666 'Douche Burger' - Businessweek http://bit.ly/LVac4D

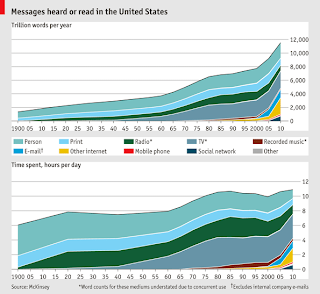

· Income Inequality Killed The Music Business | The Big Picture http://bit.ly/LXilZG

· When Craigslist Blocks Innovations - Disruptions - NYTimes.com http://bit.ly/Q9z6kZ

· Neuroscience and Moral Responsibility http://bit.ly/Q9z4JH